A US real estate house, which has launched a new fund adopting a private equity type of approach, says that there are still plenty of investment nuggets to be found even in a market where values have crept up modestly in recent years.

In September 2018, said that it was closing its targeted $100 million MLG Private Fund III and was accepting new investments into the MLG Private Fund IV as of October 1, 2018. Each of the funds acquires a geographic range of commercial real estate mainly made up of multi-family properties, industrial, retail, and office properties in several US markets.

Since MLG was set up in 1987, it has had active, exited or pending investments of about 15.5 million square feet of total space across the US, with exited and estimated current value exceeding $1.6 billion.

While not one of the largest real estate players, it is nimbler than the bigger organizations, which gives it an edge in finding and securing good value investments, David Binder, vice president at MLG Capital, told this publication recently.

Binder said that clients seek an efficient way to get a geographically diverse set of investments in multiple asset types across the US without having the hassle of sourcing on their own.

“Our secret sauce is that the firm scrutinizes 55 to 65 property opportunities a month and narrows them down dramatically so that the firm’s managers are inspecting about one to three sites a month to do a deal. This is a labor-intensive job, involving considerable expertise and local knowledge on the ground,” Binder said.

“In private commercial real estate everything is checks and balances as well as supply and demand. We like to analyze things in a million ways due to our historic experience of being an owner, operator, investor, manager and overall vertically integrated. We’ve changed toilets, we’ve survived economic cycles. We’ve lived private commercial real estate to our core and are consistently seeking to provide value to our investment clients,” he continued.

This labor-intensive approach, given its AuM, can be seen in that the firm has a total of about 300 staff across the US through all business units.

MLG tends to avoid the big coastal cities but operates in much of the US heartland, which is generally Milwaukee (its headquarters) to Minneapolis, over to Denver, down to Phoenix, across to Dallas, through to Tampa, up to the Carolinas, and over the rust belt back to Milwaukee.

A lot of properties are bought “off-market,” coming to light indirectly, Binder said. In the sector of property where values range from $5 million to $75 million, there are all kinds of inefficiencies, mistakes and contractual problems that represent opportunities for a savvy investor, he said. MLG has developed its own systems and processes to see value in locations and understand how local issues can affect real estate values.

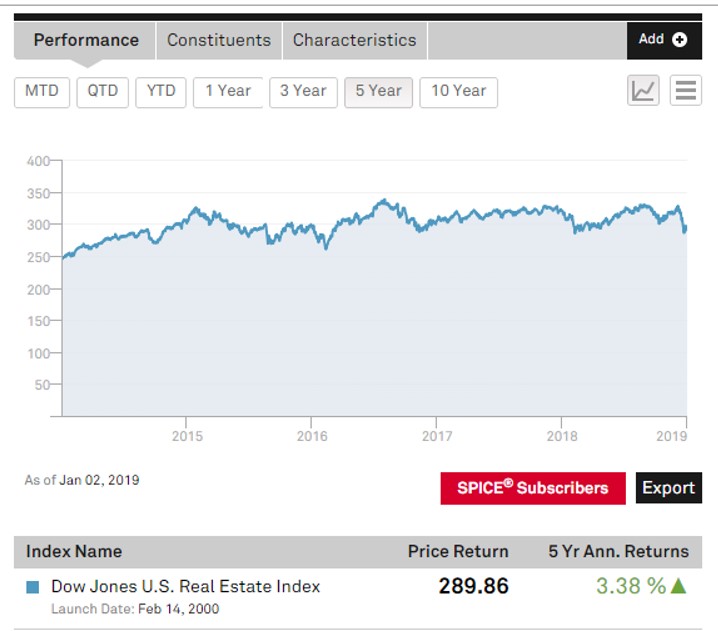

The US real estate market has slowly risen over the past five years, as shown by the graph of the Dow Jones US Real Estate Index (see chart below), showing five-year annual returns of 3.38 per cent, hardly suggesting that big gains within specific properties have been easy to find. Further evidence that investors need to hunt harder for gains came late in December from house price data on 20 US cities. Gains slowed in October for a seventh straight month. The 20-city index of property values rose by 5 per cent from a year earlier, having risen by 5.2 per cent in September, according to figures from S&P CoreLogic Case-Shiller (source: Bloomberg).

Finding value, returns

So what is Binder’s assessment of the market?

“We are still consistently finding a lot of opportunity in the marketplace. Our deal sourcing team now maintains over 1,800 contacts nationwide for joint venture deal sourcing (partnering with other firms) and countless contacts in Wisconsin, Texas and Florida where we acquire without partners and on our own,” he said.

And the MLG funds are relatively illiquid, so internal rates of return – which takes into account the timing of specific deals – are significantly better than the broader market. A real estate investment trust pays only about 3 to 4 per cent, while the IRR on an MLG fund is targeted to be in the range of 12 to 16 per cent. About half of the returns are from true operating cash flow and the other half are from appreciation over time by executing business plans to grow the underlying asset cash flow.

“In general, everything goes back to the laws of supply and demand in private commercial real estate,” Binder said.